UNION BUDGET

Presented By :

- Union Minister for Finance and Corporate Affairs, Nirmala Sitharaman, presented the Union Budget for 2026–27 on 1 February 2026.

- The presentation occurred on the dual auspicious occasion of Magha Purnima and the 649th birth anniversary of Guru Ravidas.

- This marked a historic milestone as Sitharaman presented her 9th consecutive budget and the first-ever to be delivered on a Sunday.

- This Budget is the first Union Budget prepared in Kartavya Bhawan.

PART A- VISION & PHILOSOPHY

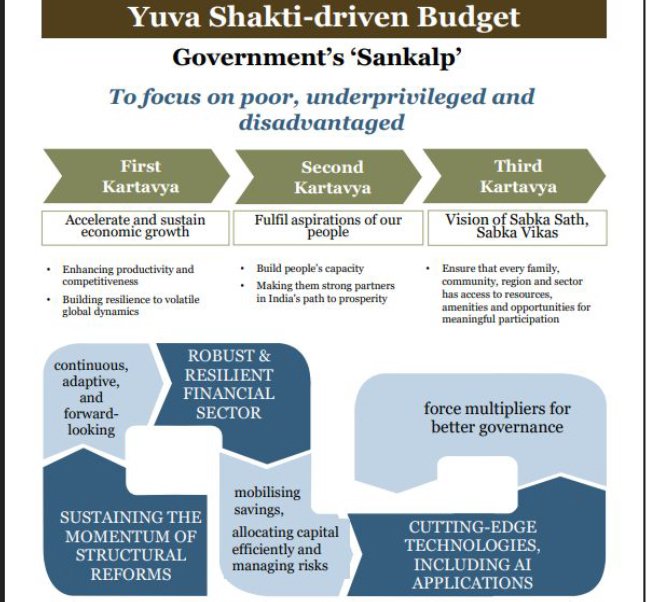

- The Budget is inspired by the philosophy of three Kartavya (duties).

- It is a Yuva Shakti–driven Budget, reflecting the Government’s Sankalp to prioritise the poor, underprivileged, and disadvantaged.

- The Budget aims to take India towards Viksit Bharat by balancing ambition with inclusion.

- India will continue to remain deeply integrated with global markets, expand exports, and attract stable long-term capital, despite global uncertainties.

1st Kartavya: Accelerating and Sustaining Economic Growth

- The first kartavya focuses on accelerating and sustaining economic growth.

- It seeks to enhance productivity and competitiveness.

- It also aims to build resilience against volatile global economic dynamics.

2nd Kartavya: Fulfilling Aspirations and Building Capacity

- The second kartavya focuses on fulfilling the aspirations of people.

- It aims to build human capacity, making citizens strong partners in India’s prosperity journey.

3rd Kartavya: Sabka Sath, Sabka Vikas

- The third kartavya aligns with the vision of Sabka Sath, Sabka Vikas.

- It ensures that every family, community, region, and sector gets access to resources, amenities, and opportunities for meaningful participation.

GLOBAL & REFORM BACKGROUND

- The Finance Minister highlighted that the global environment is currently challenging.

- Global trade and multilateralism are under strain.

- Access to resources and global supply chains is increasingly disrupted.

- New technologies are transforming production systems and sharply increasing demand for water, energy, and critical minerals.

- After the Prime Minister’s announcement on Independence Day 2025, over 350 reforms have been implemented.

- These reforms include GST simplification, notification of Labour Codes, and rationalisation of mandatory Quality Control Orders.

- High-Level Committees have been constituted, and the Centre is working with States on deregulation and compliance reduction

FIRST KARTAVYA: 6 MAJOR INTERVENTIONS

1. Scaling up Manufacturing in Strategic and Frontier Sectors :

Biopharma SHAKTI:

- Biopharma SHAKTI (Strategy for Healthcare Advancement through Knowledge, Technology and Innovation) has been announced with an outlay of ₹10,000 crore over five years.

- The objective is to develop India as a global biopharma manufacturing hub for biologics and biosimilars.

- A biopharma-focused network will be created with three new NIPERs and upgradation of seven existing NIPERs.

- A network of over 1,000 accredited India Clinical Trial sites will be established.

- The Central Drugs Standard Control Organisation (CDSCO) will be strengthened through a dedicated scientific review cadre to meet global approval timelines.

India Semiconductor Mission (ISM) 2.0 :

- ISM 2.0 will be launched to produce semiconductor equipment and materials.

- It will promote full-stack Indian IP design and strengthen semiconductor supply chains.

- Industry-led research and training centres will be created to develop skilled manpower.

Electronics and Critical Minerals :

- The outlay under the Electronics Components Manufacturing Scheme has been increased to ₹40,000 crore.

- Dedicated Rare Earth Corridors will be established in Odisha, Kerala, Andhra Pradesh, and Tamil Nadu to support mining, processing, research, and manufacturing.

- A scheme will support States in establishing three Chemical Parks through a challenge-based, cluster-oriented, plug-and-play model.

Capital Goods and Construction Equipment :

- Hi-Tech Tool Rooms will be established by CPSEs at two locations as digitally enabled automated service bureaus.

- A Construction and Infrastructure Equipment (CIE) Scheme will strengthen domestic manufacturing of high-value and technologically advanced equipment.

- A Container Manufacturing Scheme with a budgetary allocation of over ₹10,000 crore for five years will create a globally competitive ecosystem.

Textile Sector Integrated Programme :

- An Integrated Textile Programme has been announced for the labour-intensive textile sector.

- The National Fibre Scheme will promote self-reliance in silk, wool, jute, man-made fibres, and new-age fibres.

- The Textile Expansion and Employment Scheme will modernise traditional clusters through machinery support, technology upgradation, and testing facilities.

- Mega Textile Parks will be set up in challenge mode with a focus on technical textiles.

- The Mahatma Gandhi Gram Swaraj Initiative will strengthen khadi, handloom, and handicrafts and support branding, skilling, and quality improvement.

2. Rejuvenating Legacy Industrial Sectors :

- A scheme has been announced to revive 200 legacy industrial clusters.

- The focus is on improving cost competitiveness, efficiency, and infrastructure and technology upgradation.

3. Creating Champion MSMEs and Supporting Micro Enterprises :

- A dedicated ₹10,000 crore SME Growth Fund will be introduced to create Champion MSMEs.

- The Self-Reliant India Fund will receive an additional ₹2,000 crore to support micro enterprises.

- Professional institutions such as ICAI, ICSI, and ICMAI will design short-term modular courses to develop Corporate Mitras, especially in Tier-II and Tier-III towns.

4. Delivering a Powerful Push to Infrastructure :

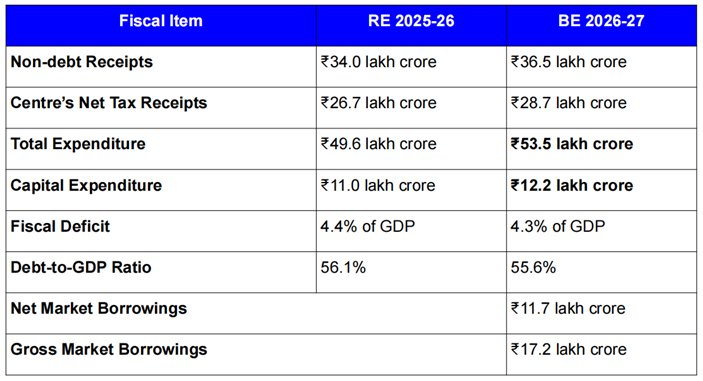

- Public capital expenditure has increased from ₹2 lakh crore in FY 2014–15 to ₹11.2 lakh crore in BE 2025–26.

- For FY 2026–27, capital expenditure has been raised to ₹12.2 lakh crore.

- An Infrastructure Risk Guarantee Fund will be established to reduce risks for private developers.

- CPSE real estate assets will be monetised through dedicated REITs.

Green Cargo and Logistics :

- New Dedicated Freight Corridors will connect Dankuni (East) to Surat (West).

- Twenty National Waterways will be operationalised over five years, starting with NW-5 in Odisha, connecting Talcher, Angul, Kalinga Nagar, Paradeep, and Dhamra.

- Regional Centres of Excellence will train manpower for waterways.

- A ship repair ecosystem will be developed at Varanasi and Patna.

- A Coastal Cargo Promotion Scheme will increase inland and coastal shipping share from 6% to 12% by 2047.

- A Seaplane VGF Scheme will promote tourism and last-mile connectivity.

5. Ensuring Long-Term Energy Security :

- An outlay of ₹20,000 crore over five years has been announced for Carbon Capture, Utilisation and Storage (CCUS)

6. Developing City Economic Regions (CERs) :

- An allocation of ₹5,000 crore per City Economic Region over five years has been announced.

- Funding will follow a challenge-based, reform-linked, and results-based financing mechanism.

- Seven High-Speed Rail Corridors will be developed as growth connectors:

- Mumbai–Pune

- Pune–Hyderabad

- Hyderabad–Bengaluru

- Hyderabad–Chennai

- Chennai–Bengaluru

- Delhi–Varanasi

- Varanasi–Siliguri

- A High-Level Committee on Banking for Viksit Bharat will review the banking sector.

- Power Finance Corporation and Rural Electrification Corporation will be restructured.

- A review of FEMA (Non-Debt Instruments) Rules will be undertaken.

- Municipal bonds will receive an incentive of ₹100 crore for issuances above ₹1,000 crore.

SECOND KARTAVYA: FULFILLING ASPIRATIONS & BUILDING CAPACITY

- Close to 25 crore people have exited multidimensional poverty over the last decade.

- Five Regional Medical Hubs will promote medical tourism with AYUSH centres and rehabilitation facilities.

- A loan-linked capital subsidy scheme will support the creation of over 20,000 veterinary professionals.

- The AVGC sector, projected to need 2 million professionals by 2030, will be supported through labs in 15,000 schools and 500 colleges.

- One girls’ hostel will be established in every district in STEM institutions.

- The National Council for Hotel Management and Catering Technology will be upgraded to a National Institute of Hospitality.

- A pilot scheme will upskill 10,000 tourist guides through a 12-week hybrid course with an IIM.

- A Khelo India Mission will transform the sports sector over the next decade.

THIRD KARTAVYA: SABKA SAATH SABKA VIKAS

- Bharat-VISTAAR, a multilingual AI-based tool, will integrate AgriStack and ICAR to support farmers.

- SHE Marts will be set up as community-owned retail outlets.

- NIMHANS-2 will be established, and institutes in Ranchi and Tezpur will be upgraded.

- An East Coast Industrial Corridor with a node at Durgapur will be developed.

- Five tourism destinations, 4,000 e-buses, and a Buddhist Circuit Scheme in the North-East will be implemented.

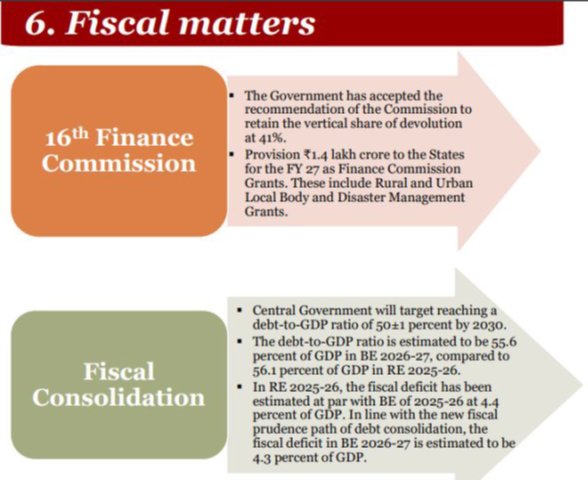

Fiscal Consolidation

- The debt-to-GDP ratio is estimated at 6% in BE 2026–27, compared to 56.1% in RE 2025–26.

- The fiscal deficit is estimated at 3% of GDP in BE 2026–27.

PART B: UNION BUDGET (2026-27) TAXATION REFORMS

- PART–B of the Union Budget 2026–27 focuses on Direct Taxes, Indirect Taxes, Customs reforms, Tax administration, Ease of Living, and Ease of Doing Business.

- The reforms aim to simplify tax laws, reduce litigation, improve compliance, and enhance India’s attractiveness for global investment, while protecting honest taxpayers.

DIRECT TAXES

New Income Tax Act, 2025

- The New Income Tax Act, 2025 will come into effect from April 2026.

- The Act aims to create a simpler, clearer, and citizen-friendly tax law.

- Simplified Income Tax Rules and Forms will be notified shortly.

- The new forms are redesigned to ensure easy compliance for ordinary citizens, especially small taxpayers.

EASE OF LIVING FOR TAXPAYERS

Income Tax Exemptions

- Interest awarded by the Motor Accident Claims Tribunal (MACT) to a natural person will be fully exempt from Income Tax.

- Any Tax Deducted at Source (TDS) on such interest income will be removed.

TCS Rationalisation

- The Tax Collected at Source (TCS) rate on overseas tour program packages has been reduced to 2 percent, from the earlier range of 5 percent and 20 percent, without any threshold limit.

- The TCS rate under the Liberalised Remittance Scheme (LRS) for education and medical purposes has been reduced from 5 percent to 2 percent.

TDS Reforms

- The supply of manpower services will now be treated as payment to contractors for TDS purposes.

- TDS on such manpower services will be levied at 1 percent or 2 percent only, benefiting labour-intensive sectors.

- A rule-based automated system will allow small taxpayers to obtain lower or nil TDS certificates without approaching the assessing officer.

Return Filing Reforms

- The time limit for revising income tax returns has been extended from 31st December to 31st March, subject to payment of a nominal fee.

- The timeline for filing tax returns will be staggered to reduce system congestion.

- A single-window filing facility will be introduced through depositories for Form 15G and Form 15H.

- For property transactions involving NRIs, the requirement of a Tax Deduction Account Number (TAN) will be replaced with a PAN-based challan of the resident buyer.

Foreign Asset Disclosure Scheme

- A one-time 6-month foreign asset disclosure scheme will be introduced.

- The scheme will apply to students, young professionals, tech employees, relocated NRIs, and small taxpayers.

- It will allow disclosure of foreign income or assets below a specified threshold without harsh penalties.

Rationalisation of Penalty and Prosecution

- Assessment and penalty proceedings will be integrated into a single common order, reducing multiplicity of proceedings.

- The pre-deposit requirement for filing appeals will be reduced from 20 percent to 10 percent, calculated only on core tax demand.

- Taxpayers will be allowed to update returns even after reassessment proceedings have begun, by paying an additional 10 percent tax.

- Immunity from penalty and prosecution will be extended from cases of under-reporting to misreporting of income, subject to payment of 100 percent additional tax.

- The prosecution framework under the Income Tax Act will be rationalised.

- Non-production of books of account, and TDS defaults where payment is made in kind, will be decriminalised.

- Non-disclosure of non-immovable foreign assets with an aggregate value of less than ₹20 lakh will be granted immunity from prosecution, with retrospective effect from 1 October 2024.

Taxation of Cooperatives

- The existing deduction available to primary cooperative societies supplying milk, oilseeds, fruits, or vegetables will be extended to include cattle feed and cotton seed produced by members.

- Inter-cooperative society dividend income will be allowed as a deduction under the new tax regime, to the extent it is distributed to members.

- Dividend income received by a notified national cooperative federation will be exempt from tax for three years, for investments made up to 31 January 2026, provided the dividend is further distributed to member cooperatives.

Supporting the IT Sector as India’s Growth Engine

- Software development services, IT-enabled services, Knowledge Process Outsourcing (KPO), and contract R&D services will be clubbed into a single category called Information Technology Services.

- A uniform safe harbour margin of 15.5 percent will apply to this category.

- The threshold for availing safe harbour will be increased from ₹300 crore to ₹2,000 crore.

- Safe harbour approval will be granted through an automated, rule-driven process.

- Once opted, the safe harbour can be continued for five consecutive years.

- The Unilateral Advanced Pricing Agreement (APA) process for IT services will be fast-tracked, with an effort to conclude within two years, extendable by six months.

- The facility of modified returns available to an entity entering into an APA will be extended to its associated entities.

Attracting Global Business and Investment

- Any foreign company providing cloud services globally using Indian data centres will be granted a tax holiday till 2047.

- A safe harbour margin of 15 percent on cost will apply where data centre services are provided by a related entity.

- A safe harbour regime will apply to non-residents for component warehousing in bonded warehouses, with a profit margin of 2 percent of invoice value, resulting in an effective tax of about 0.7 percent.

- Non-residents supplying capital goods, equipment, or tooling to toll manufacturers in bonded zones will receive income tax exemption for five years.

- Non-resident experts will receive exemption on global (non-India sourced) income for a stay period of five years under notified schemes.

- All non-residents paying tax on a presumptive basis will be exempt from Minimum Alternate Tax (MAT).

Tax Administration Reforms

- A Joint Committee of the Ministry of Corporate Affairs and the Central Board of Direct Taxes (CBDT) will be constituted.

- The committee will integrate Income Computation and Disclosure Standards (ICDS) into Indian Accounting Standards (IndAS).

- From tax year 2027–28, separate accounting under ICDS will be eliminated.

- The definition of “accountant” under Safe Harbour Rules will be rationalised.

Other Direct Tax Proposals

- Buyback of shares for all shareholders will be taxed as Capital Gains.

- Promoters will pay an additional buyback tax, resulting in an effective rate of 22 percent for corporate promoters and 30 percent for non-corporate promoters.

- The TCS rate on alcoholic liquor, scrap, and minerals will be rationalised to 2 percent.

- The TCS rate on tendu leaves will be reduced from 5 percent to 2 percent.

- Securities Transaction Tax (STT) on futures will increase from 0.02 percent to 0.05 percent.

- STT on options premium and exercise of options will increase to 0.15 percent.

- MAT credit set-off will be allowed only under the new tax regime, limited to one-fourth of tax liability.

- MAT will become a final tax, with the rate reduced from 15 percent to 14 percent, and no further credit accumulation from 1 April 2026.

INDIRECT TAXES

Objectives of Indirect Tax Reforms

Indirect tax proposals aim to simplify tariff structure, support domestic manufacturing, promote exports, and correct inverted duty structures.

Rationalisation of Customs Duties

Marine, Leather, and Textile Sectors

- Duty-free import of inputs for seafood processing will increase from 1 percent to 3 percent of FOB value.

- Duty-free import of specified inputs will be allowed for leather and synthetic footwear exports.

Energy Transition and Security

- Basic Customs Duty (BCD) exemption on capital goods for Lithium-Ion cell manufacturing will be extended.

- BCD on sodium antimonate for solar glass manufacturing will be exempted.

Nuclear Power

- BCD exemption for imports required for Nuclear Power Projects will be extended till 2035.

Critical Minerals

- BCD on capital goods required for processing of critical minerals will be exempted.

Biogas Blended CNG

- The entire value of biogas will be excluded while calculating Central Excise duty on biogas-blended CNG.

Civil and Defence Aviation

- BCD exemption will apply to components and parts for aircraft manufacturing.

- Raw materials for aircraft MRO activities in the defence sector will also be exempted.

Electronics

- BCD exemption will apply to specified parts used in microwave oven manufacturing.

Special Economic Zones (SEZs)

- A one-time concessional duty window will allow eligible SEZ units to sell to the Domestic Tariff Area (DTA), subject to export-linked limits.

Ease of Living (Customs)

- Import duty on personal use goods will be reduced from 20 percent to 10 percent.

- 17 drugs and medicines will receive full BCD exemption.

- Seven additional rare diseases will qualify for duty-free personal imports of drugs and FSMP.

Customs Process Simplification and Trust-Based Systems

- Customs procedures will move towards minimal intervention.

- Duty deferral period for Tier-2 and Tier-3 AEOs will increase from 15 days to 30 days.

- Advance ruling validity will increase from 3 years to 5 years.

- Trusted importers will receive automatic clearance notifications.

- Customs warehousing will shift to a warehouse operator-centric model with electronic tracking and risk-based audits.

Ease of Doing Business and Trade Facilitation

- Cargo clearances will be processed through a single digital window.

- Processes covering food, drugs, plant, animal, and wildlife products will be integrated by April 2026.

- The Customs Integrated System (CIS) will be rolled out in two years.

- AI-based non-intrusive scanning will be expanded to scan every container at major ports.

New Export Opportunities

- Fish catch in India’s EEZ or high seas will be made duty-free.

- Landing fish at foreign ports will be treated as export of goods.

- The ₹10 lakh per consignment cap on courier exports will be fully removed to support MSMEs, artisans, and startups.

Ease of Living for Travellers and Taxpayers

- Baggage clearance rules will be revised to enhance duty-free allowances.

- Honest taxpayers will be allowed to settle disputes by paying an additional amount in lieu of penalty.

Note: Connect with Vajirao & Reddy Institute to keep yourself updated with latest UPSC Current Affairs in English.

Note: We upload Current Affairs Except Sunday.

The post UNION BUDGET appeared first on Vajirao IAS.